A Lease to Own Agreement, also called a “Rent to Own Agreement” is a contract signed between a landlord (or property seller) and a tenant that permits the tenant to rent the property for a duration of one (1) to several years, with the added option that the tenant can purchase the property at the end of the term, if they so choose. In other words, the agreement can be thought of as two (2) separate documents compiled into one; a standard residential lease and a purchase agreement.

A lease-to-own agreement is a binding legal document used for establishing a set of terms, rules, and conditions around the initial lease of a residential property, and the subsequent selling of said property (if the tenant chooses to purchase). The agreement is a popular option for tenants that are looking to purchase a home, but due to financial constraints cannot do so in the current moment. Common reasons for this include the tenant not being able to afford a down payment or not having a strong enough credit score to obtain a loan.

For homeowners that are 1) in no rush to sell their home, and 2) are looking for a stable investment opportunity, putting their home on the market as a lease-to-own may be their best option. It’s worth noting that real estate agents may be hired for assistance with the creation of the contract, but other than that, agents are often not involved, as they would have no way of earning compensation other than by the selling of the property, which would most likely be several years into the future. Subjects and conditions that the parties to the agreement typically negotiate and discuss include:

The average term of a lease to own agreement is between one (1) and three (3) years, although any length of time can be negotiated. Unlike standard leases, the length of the lease to own can make or break the tenant’s ability to purchase the home at the end-date of the contract. This is because, during the time between the contract’s beginning and end date, the tenant is aiming to raise their credit score in order to qualify for a mortgage by making on-time payments. Additionally, the tenant will be looking to build up a down payment through each subsequent rental payment, as an agreed-upon portion of each payment will accrue in a credit. The more consecutive payments, the larger the down payment credit.

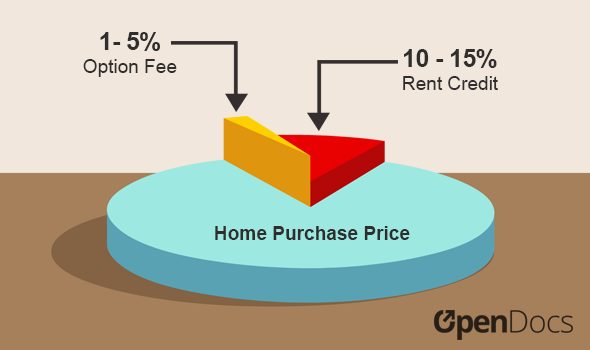

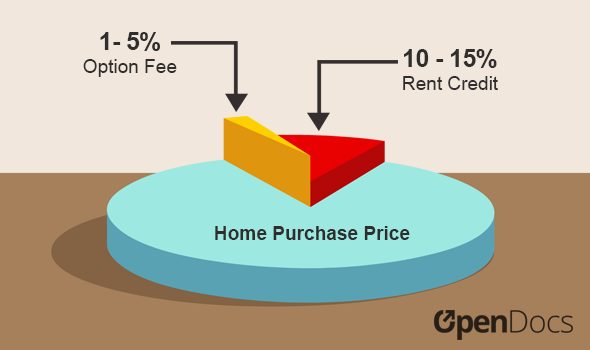

Two (2) aspects unique to lease to own agreements are option fees and rent credits. An option fee is a percentage of the home purchase price that is agreed upon before the signing of the lease. It typically ranges between 1 and 5%, although the homeowner can attempt to negotiate any percentage value. The option fee serves the purpose of allowing the tenant to purchase the property at any time during the lease. Hence, the option fee gives them the “option” of making a purchase. The rent credit is a portion of the monthly rent, typically between ten (10) and fifteen (15) percent, that accrues for the purpose of both reducing the purchase price of the home and contributing towards a down payment for the home. This fee is almost always non-refundable – if the tenant backs out and doesn’t purchase the property, the property owner keeps all of the credit.

Prior to the signing of the lease, the parties will negotiate a purchase price for the property. It is recommended that the price is not negotiated at a later date, as the collection of the option fee is meant to give the tenant the option to purchase any time throughout the course of the lease. The monetary amount that is agreed-upon will remain unchanged throughout the duration of the lease. It is recommended that homeowners negotiate a price that is slightly higher than market value due to the likelihood of the home to appreciate.

Out of all portions of the agreement that can be negotiated, maintenance and utility costs are some of the most important. Both parties will need to carefully write down each type of cost and which party is responsible for paying for it. In some cases, the landlord may be willing to pay for all maintenance, insurance, and utilities aside from routine grass mowing and other routine tasks. In other cases, the landlord may expect the tenant to hold responsibility for the majority of the home costs. Regardless of what is decided, the section should spell out exactly what is agreed upon to avoid disputes later down the road. Hiring an attorney to go over the contract can ensure fairness and help point out any unforeseen conditions in the contract.

Much like a mechanic needs to use the right tool for the job, property owners need to select the right type of contractual agreement for their situation. Unlike traditional leases, lease to own agreements are more complicated in nature due to encompassing two (2) contracts in one, and as such, property owners need to be 100% certain the leasing method is right for them. The pros and cons of a lease to own agreement (in the eyes of a property owner) are the following:

Pros

Cons